As businesses move toward digital transformation, ERP Payment Integration has emerged as a critical component of efficient financial management. It connects your Enterprise Resource Planning (ERP) system directly with payment gateways, banks, and financial institutions, automating the end-to-end flow of funds while eliminating manual errors and improving compliance. Whether you manage accounts payable, receivables, or payroll, integrating payments with your ERP system simplifies operations, enhances security, and ensures real-time visibility into your cash flow.

What is ERP Payment Integration?

ERP Payment Integration is the seamless connection between an ERP system and digital payment platforms, such as bank APIs, credit card processors, payment gateways (like Stripe, PayPal, Razorpay), or digital wallets. It allows businesses to process payments directly from within their ERP interface — whether it’s paying suppliers, receiving customer payments, or managing refunds.

This integration creates a unified financial ecosystem where transactions, accounting entries, approvals, and reconciliations happen in real time, without switching between multiple tools or spreadsheets.

Key Features of ERP Payment Integration

1. Automated Payment Processing

Send and receive payments directly through your ERP system — reducing manual data entry and improving transaction accuracy.

2. Multi-Currency and Multi-Mode Payments

Supports payments across different countries and currencies, including bank transfers, credit/debit cards, UPI, NEFT, RTGS, or wallets.

3. Instant Reconciliation

ERP payment integration allows automatic bank reconciliation, matching payments with invoices and updating the ledger instantly.

4. Secure Payment Gateways

Works with PCI-DSS compliant payment gateways and banking APIs to ensure the highest level of data encryption and fraud protection.

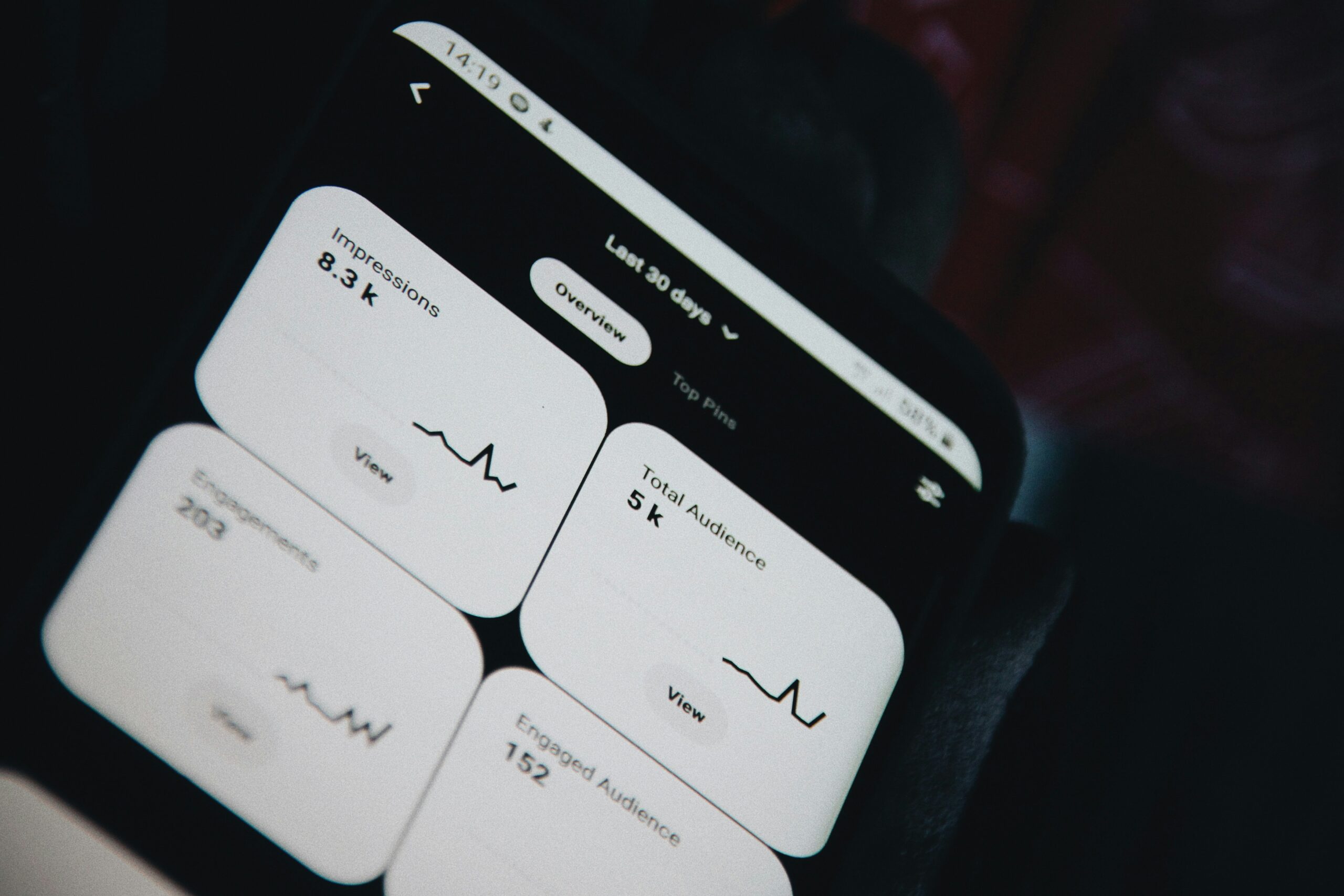

5. Real-Time Payment Status Tracking

Track every payment’s status — pending, failed, successful — directly from your ERP dashboard, with real-time alerts and notifications.

6. Approval Workflows

Customizable multi-level approvals for outgoing payments ensure internal controls, compliance, and accountability.

Benefits of ERP Payment Integration

1. Enhanced Efficiency

Automating payments through ERP reduces the time spent on manual processing, approvals, and reconciliations, freeing up finance teams to focus on strategy.

2. Reduced Errors and Duplicates

By eliminating manual entry across systems, ERP-integrated payments drastically cut down duplicate transactions, incorrect amounts, and payment mismatches.

3. Faster Cash Flow Cycles

Receive payments faster through online payment links or automated reminders generated from within the ERP, improving working capital management.

4. Centralized Financial Control

Get a 360-degree view of payables and receivables across the organization, aiding decision-making and budgeting.

5. Compliance and Audit Readiness

With every payment logged, timestamped, and linked to a document trail, ERP systems make it easy to maintain regulatory compliance and internal audits.

Use Cases of ERP Payment Integration

1. Customer Invoicing and Payments

Generate invoices in ERP and automatically embed payment links using integrated gateways like Stripe or Razorpay. Receive real-time payment confirmation and update receivables.

2. Supplier Payments

Schedule and approve supplier payments via NEFT, IMPS, or ACH directly from the ERP after PO and GRN validation, reducing delays and penalties.

3. Subscription Billing and Recurring Payments

For SaaS businesses or services, automate recurring billing and payment collection with ERP-connected subscription modules and payment APIs.

4. Employee Payroll and Reimbursements

Connect your payroll module with bank APIs to automate monthly salary disbursements and employee reimbursement processing.

5. E-Commerce Integration

Sync your ERP with e-commerce platforms and payment processors to automatically post orders, track payments, and manage refunds.

How ERP Payment Integration Works

- Invoice Generation: ERP generates invoices for customers or bills for vendors.

- Payment Request: System initiates payment using integrated gateways or bank APIs.

- Authorization: Configurable multi-level approval workflows trigger based on thresholds or vendor category.

- Transaction Execution: The payment is executed in real-time via the selected channel (bank transfer, UPI, credit card).

- Reconciliation: The system automatically reconciles the payment with the invoice or bill and updates the ledger.

- Reporting: Finance teams receive real-time reports on payment status, cash flow, and financial health.

Top ERP Platforms Supporting Payment Integration

1. SAP S/4HANA

Offers direct bank connectivity, payment file generation, and integrations with leading gateways for real-time treasury management.

2. Oracle NetSuite

Features native payment modules integrated with gateways like PayPal, Stripe, and SuitePayments for unified billing and collections.

3. Microsoft Dynamics 365

Provides seamless integrations with Microsoft Pay, Stripe, and other platforms, with embedded automation for approvals and ledger updates.

4. Odoo ERP

Open-source and modular, Odoo supports payment integrations with PayPal, Razorpay, Authorize.net, and local banks, ideal for SMEs.

5. Zoho Books and Zoho ERP

Cloud ERP with robust payment link generation and integration with Indian and international gateways for SMEs and service-based businesses.

6. Wybrid Super App

Cloud based solution with fully integration. ERP, CRM, Live tracking and many more for every cowokring space.

Choosing the Right Payment Integration for Your ERP

Consider the following when selecting an ERP payment integration:

- Supported Payment Methods – Ensure your ERP supports the modes your customers and vendors prefer.

- Country and Currency Coverage – Choose gateways that support your operating geographies and currencies.

- Security and Compliance – Look for PCI-DSS certification, two-factor authentication, and encryption standards.

- Custom Workflows – Integration should allow you to define payment thresholds, approval hierarchies, and alert triggers.

- API Availability – Open APIs ensure easier customization and future scalability.

- Integration Costs – Check for gateway fees, transaction charges, and ERP module licensing.

Challenges in ERP Payment Integration

1. Integration Complexity

Legacy ERP systems may not have native support for modern payment APIs, requiring custom connectors or middleware.

2. Data Synchronization Issues

Improper synchronization between ERP and payment gateways can lead to unmatched transactions and financial discrepancies.

3. Cybersecurity Risks

Payment integrations introduce vulnerabilities if not properly secured. It is vital to ensure bank-grade encryption and access control mechanisms.

4. Compliance Requirements

International businesses must meet local tax and financial regulations, requiring localization of ERP and payment systems.

The Future of ERP Payment Integration

1. AI-Powered Fraud Detection

ERP systems will integrate AI algorithms to flag unusual payment patterns and prevent fraud in real time.

2. Embedded Finance and BNPL

Expect ERP platforms to offer embedded finance capabilities like Buy Now Pay Later (BNPL) and invoice financing within the platform.

3. Blockchain and Smart Contracts

Secure, automated smart contracts may soon facilitate automated, conditional payments, especially in procurement and supply chain.

4. Instant Payments via UPI and RTP

The future lies in real-time payment infrastructure like India’s UPI or the US RTP network, fully integrated within ERP environments.

Conclusion

ERP Payment Integration is no longer a luxury — it’s a necessity for businesses that value speed, transparency, and control. It streamlines the financial supply chain, reduces operational risks, and empowers finance teams with real-time visibility. As cloud-based ERP systems evolve, embedded and intelligent payment features will become standard — making payment integration a strategic advantage.